The venture capital landscape in 2025 presents a complex interplay of challenges and opportunities, with venture capital trends reflecting both economic uncertainty and technological innovation. As we navigate through this year, understanding the current investment climate is crucial for founders, investors, and industry observers alike. Despite record-breaking funding in early 2025, the venture ecosystem faces significant headwinds that are reshaping how capital flows to startups across various sectors.

The Current State of Venture Capital in 2025

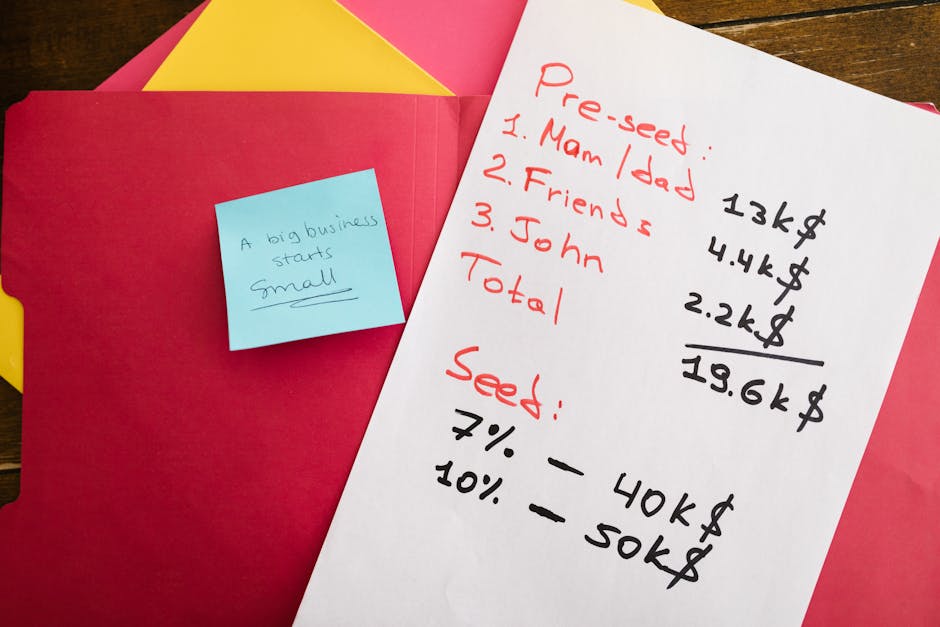

Photo by RDNE Stock project on Pexels

The first quarter of 2025 defied expectations with venture capital funding reaching an impressive $91.5 billion globally. This figure represents an 18.5% increase from the previous quarter and stands as the second-highest quarterly investment recorded in the past decade. However, this surge in funding masks deeper concerns within the investment community.

Geopolitical uncertainty has emerged as the top concern among venture capital General Partners (GPs) and Limited Partners (LPs), capturing 7.5% of votes in a comprehensive global survey. This uncertainty, coupled with increasing cybersecurity threats (6.0%), has created a cautious investment environment despite the impressive funding numbers.

The anticipated liquidity events that many expected would characterize 2025 have largely failed to materialize. Market volatility and recession fears, triggered in part by new tariff policies, have disrupted the traditional cycle where IPOs and major acquisitions generate capital that flows back into the startup ecosystem. Several high-profile companies, including fintech giant Klarna and physical therapy innovator Hinge, have postponed their public market debuts amid the turbulence.

Despite these challenges, certain sectors continue to attract significant venture capital attention, with Deep Tech & Robotics (6.7%) and AI & Machine Learning (6.3%) leading the growth categories. This selective investment approach highlights how venture capital trends are evolving in response to both market conditions and technological advancement.

Sector-Specific Investment Trends

Photo by Rostislav Uzunov on Pexels

The venture capital landscape in 2025 shows distinct patterns of investment across different sectors, with technology-driven industries continuing to dominate funding allocations. Understanding these sector-specific trends provides valuable insights for founders seeking capital and investors looking to optimize their portfolios.

Artificial Intelligence and Machine Learning remain powerhouses in the venture ecosystem, with the AI industry projected to reach $243.7 billion in 2025. This remarkable growth is fueled by increasing integration across multiple sectors, particularly healthcare, fintech, and enterprise software. Major funding rounds continue to flow into AI startups despite the overall cautious investment climate, reflecting strong confidence in AI’s transformative potential.

Climate Tech has emerged as another significant investment category, with investors holding an estimated $86 billion in available capital specifically earmarked for climate-focused startups. Interestingly, the investment thesis in this space has evolved from supporting solutions that rely on a “green premium” to prioritizing commercially viable and scalable technologies. Key growth areas include AI-powered climate solutions, advanced power management systems, earth observation technologies, and adaptation solutions such as wildfire detection systems and energy storage innovations.

The Crypto and Blockchain sector has shown remarkable resilience, with crypto startups raising $5.85 billion in Q1 2025 alone—already accounting for 61% of all capital raised in this sector during 2024. While institutional investors remain somewhat hesitant, project-level investment is gaining momentum, particularly in centralized finance (CeFi), blockchain infrastructure development, and real-world asset tokenization. This renewed interest suggests that the sector is maturing beyond speculative investments toward more practical applications of blockchain technology.

Other notable sectors experiencing growth include Space Technology (3.6%), Health & Biosciences (3.2%), and FinTech (4.0%). Each of these areas represents significant opportunities for innovation and investment, contributing to the diverse venture capital trends shaping 2025.

Challenges Facing the Venture Ecosystem

Photo by RDNE Stock project on Pexels

Despite the impressive funding figures reported in early 2025, the venture capital ecosystem faces several significant challenges that threaten to disrupt the traditional investment cycle. These obstacles are reshaping venture capital trends and forcing both investors and founders to adapt their strategies accordingly.

The exit environment has deteriorated dramatically, with IPOs and major acquisitions falling well below expectations. This liquidity crunch has serious implications for the entire venture ecosystem, as it disrupts the cycle where successful exits generate returns that are then reinvested into new startups. Market analysts who have covered the venture space for over a decade report unprecedented pessimism regarding dealmaking prospects for the remainder of 2025.

Stock market volatility has become a major deterrent for companies considering public offerings. Startups are understandably reluctant to debut on public markets when stock prices are depressed due to global economic concerns. This hesitation is compounded by fears of a potential recession, which many attribute to recent policy shifts including new tariff implementations. The postponement of planned IPOs by companies like Klarna and Hinge illustrates how these concerns are affecting even well-established late-stage startups.

Startup failure rates continue to present a sobering reality, with 42% of startups collapsing due to misreading market demand—essentially creating products that nobody wants or needs. Financial constraints account for another 29% of failures, highlighting the critical importance of both market validation and sustainable funding strategies. In the current environment of limited exits and cautious investment, these failure factors become even more pronounced.

Gender disparities in funding represent another persistent challenge within the venture ecosystem. Recent data shows that male founders secured £156.2 billion in venture capital, while women founders raised just £28.1 billion during the same period. This significant imbalance indicates that despite increased awareness of diversity issues, the venture capital industry still has substantial progress to make in creating equitable funding opportunities.

Emerging Opportunities for Investors and Founders

Photo by RDNE Stock project on Pexels

Despite the challenges facing the venture capital ecosystem in 2025, significant opportunities exist for both investors and founders who can navigate the current landscape strategically. Understanding these opportunities is essential for capitalizing on venture capital trends while mitigating associated risks.

The rise of emerging managers represents a notable shift in the venture capital landscape, accounting for 4.0% of identified trends. These newer fund managers often bring fresh perspectives, specialized expertise, and innovative investment approaches that can uncover overlooked opportunities. For founders, especially those operating outside traditional startup hubs or in niche sectors, these emerging managers may offer more accessible funding options and hands-on support compared to established firms.

Diverse Limited Partners are increasingly entering the venture ecosystem, representing 4.0% of identified trends. This diversification of capital sources—including sovereign wealth funds, family offices, corporate venture arms, and community-focused investment vehicles—creates new funding pathways for startups that might not align with traditional venture capital criteria. For founders, understanding and targeting these alternative capital sources can provide both financial resources and strategic partnerships.

Valuation decreases, while challenging for existing portfolio companies, present opportunities for new investments. With 4.0% of respondents identifying this trend, it’s clear that more reasonable entry valuations are creating attractive investment conditions for disciplined investors. For founders raising capital in 2025, this environment requires realistic valuation expectations but may also mean dealing with investors who have more balanced risk-return profiles and longer-term perspectives.

Startup talent growth (4.4%) represents another significant opportunity, as economic uncertainty in other sectors drives skilled professionals toward entrepreneurial ventures. This influx of talent enhances the quality of founding teams and strengthens the overall startup ecosystem. For investors, this trend increases the likelihood of identifying high-potential teams capable of executing complex business models and navigating challenging market conditions.

AI-powered investment tools (4.4%) are transforming how venture capitalists identify, evaluate, and support portfolio companies. These technologies enable more data-driven decision-making, efficient due diligence processes, and enhanced portfolio management capabilities. For founders, understanding how these tools influence investment decisions can help in positioning their startups more effectively when seeking funding.

Strategic Approaches for Navigating Venture Capital in 2025

Photo by Artem Podrez on Pexels

Successfully navigating the venture capital landscape in 2025 requires strategic approaches tailored to the current investment climate. For both founders seeking funding and investors deploying capital, understanding how to adapt to evolving venture capital trends is essential for achieving desired outcomes.

For founders, extending runway has become a critical priority given the uncertain exit environment. This approach involves careful cash management, prioritizing sustainable growth over rapid expansion, and potentially accepting lower valuations in exchange for longer operational timelines. By focusing on capital efficiency and clear paths to profitability, startups can reduce their dependence on frequent funding rounds and position themselves to weather potential market downturns.

Sector alignment represents another crucial strategy, with founders increasingly tailoring their pitches to highlight connections to high-growth areas like AI, climate tech, and deep tech. This doesn’t necessarily mean pivoting the core business but rather emphasizing how the startup leverages or complements these trending technologies. For investors, maintaining a balanced portfolio with exposure to these growth sectors while avoiding overconcentration provides both upside potential and risk mitigation.

Alternative funding structures are gaining prominence as traditional venture capital becomes more selective. Revenue-based financing, venture debt, grants, strategic corporate partnerships, and crowdfunding all offer viable alternatives to equity financing. For founders, exploring these options can provide capital without dilution while potentially offering more flexible terms than traditional venture investments. Investors are also increasingly considering these structures as complements to their equity investments, creating blended capital approaches that reduce risk while maintaining upside exposure.

International diversification presents opportunities for both founders and investors looking beyond traditional startup hubs. While geopolitical uncertainty remains a concern, emerging ecosystems in Southeast Asia, Latin America, Eastern Europe, and Africa offer access to innovative startups, unique market opportunities, and often more favorable valuations. For founders in these regions, highlighting local market expertise and growth potential can attract investors seeking geographical diversification.

Demonstrable traction has become increasingly important in the current funding environment. Investors are prioritizing startups with clear evidence of product-market fit, customer adoption, and revenue growth over those with merely promising concepts. For founders, focusing on achieving and documenting meaningful business milestones before seeking funding can significantly improve capital-raising prospects, even in challenging market conditions.

The Future of Venture Capital Beyond 2025

Photo by Valerie Sutton on Pexels

Looking beyond the immediate challenges and opportunities of 2025, several emerging trends are likely to shape the future of venture capital in the coming years. These developments will influence how capital is allocated, how startups are evaluated, and how the broader innovation ecosystem evolves.

Regulatory frameworks for emerging technologies, particularly AI, are expected to significantly impact investment strategies and startup operations. With 3.2% of survey respondents identifying AI regulation increases as a notable trend, it’s clear that the regulatory landscape will play an increasingly important role in venture capital decision-making. Investors will need to develop expertise in navigating complex regulatory environments, while founders must build compliance considerations into their product development and go-to-market strategies from early stages.

The integration of artificial intelligence into investment processes is likely to accelerate, transforming how venture capitalists source deals, conduct due diligence, and support portfolio companies. These AI-powered investment tools (4.4%) will enable more data-driven decision-making while potentially reducing human biases in the investment process. However, the human elements of venture capital—relationship building, founder mentorship, and strategic guidance—will remain crucial differentiators for successful investors.

Sector convergence is becoming increasingly evident, with traditional industry boundaries blurring as technologies like AI, blockchain, and advanced materials find applications across multiple domains. This convergence creates opportunities for cross-sector innovation and investment strategies that leverage expertise from different fields. Venture firms that can build multidisciplinary teams and develop thesis-driven approaches spanning multiple sectors may gain advantages in identifying promising convergence opportunities.

Sustainability metrics are likely to become standard components of investment evaluation frameworks, extending beyond dedicated climate tech investments to influence decisions across all sectors. As environmental and social considerations become increasingly important to consumers, regulators, and talent markets, startups that proactively address these factors will attract both capital and market share. Venture capitalists who develop expertise in evaluating sustainability impacts and opportunities will be better positioned to identify resilient, future-proof investments.

Democratization of venture capital continues to evolve through new investment vehicles, platforms, and regulatory changes that make startup investing more accessible to a broader range of participants. This trend has the potential to expand the capital pool available to startups while creating more diverse and representative investor bases. For the venture ecosystem as a whole, this democratization may lead to more innovative funding models and investment theses that better reflect diverse market needs and opportunities.

Conclusion: Adapting to the Evolving Venture Capital Landscape

Photo by Ir Solyanaya on Pexels

The venture capital landscape of 2025 presents a complex mix of challenges and opportunities that require adaptive strategies from all participants in the innovation ecosystem. Despite record funding in early 2025, the anticipated wave of exits has failed to materialize, creating liquidity constraints that reverberate throughout the venture capital value chain. Geopolitical uncertainty, market volatility, and shifting sector dynamics further complicate the investment environment.

Yet within these challenges lie significant opportunities for those who can navigate the evolving venture capital trends strategically. Growth sectors like AI, climate tech, and deep tech continue to attract substantial investment, while emerging managers, diverse limited partners, and alternative funding structures create new pathways for capital formation and deployment. The increasing availability of startup talent and the development of AI-powered investment tools further enhance the potential for innovation and value creation.

For founders, success in this environment requires extending runway, demonstrating clear traction, aligning with growth sectors, exploring alternative funding sources, and potentially looking beyond traditional startup hubs for capital and opportunities. For investors, balancing portfolio exposure, leveraging technology in the investment process, developing sector-specific expertise, and considering diverse investment structures and geographies can help optimize returns while managing risk.

As we look beyond 2025, the venture capital ecosystem will continue to evolve in response to regulatory developments, technological advancements, sustainability imperatives, and democratization trends. Those who can anticipate and adapt to these changes—while maintaining focus on fundamental value creation—will be best positioned to thrive in the future venture landscape.

The current venture capital trends reflect both the resilience and adaptability of the innovation ecosystem. Despite significant headwinds, capital continues to flow to promising startups, new investment models are emerging, and technological advancement proceeds unabated. By understanding these trends and developing strategic responses, both founders and investors can navigate the challenges of 2025 while positioning themselves for long-term success in an ever-changing venture capital landscape.

Sources

- https://govclab.com/2025/04/08/q2-2025-venture-trends-results/

- https://techcrunch.com/2025/04/16/startup-funding-hit-records-in-q1-but-the-outlook-for-2025-is-still-awful/

- https://explodingtopics.com/blog/fast-growing-companies

- https://stripe.com/resources/more/startup-industry-trends-for-2025-what-founders-need-to-know

- https://ff.co/startup-statistics-guide/