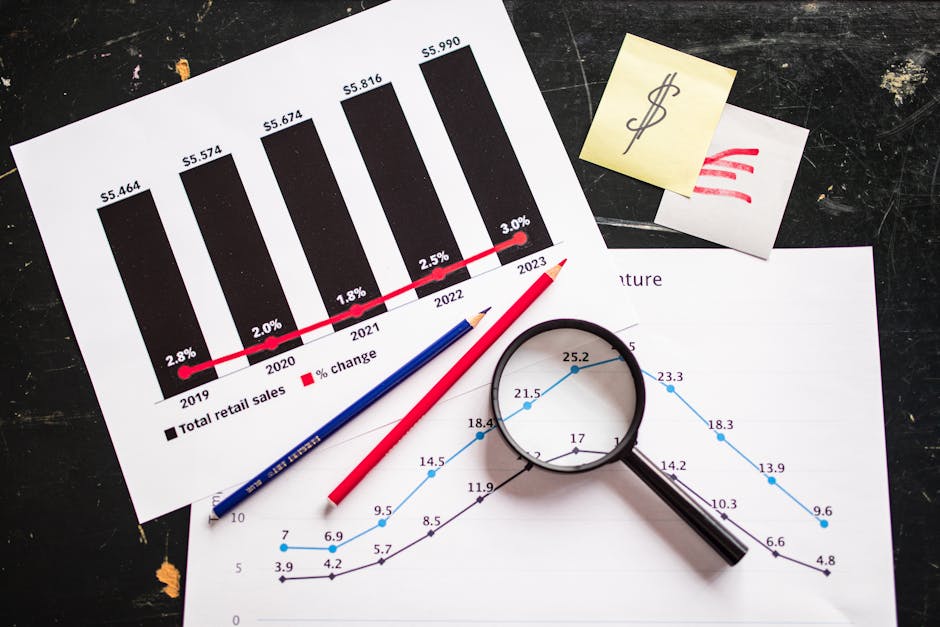

The venture capital landscape in 2025 has evolved dramatically, presenting both challenges and opportunities for founders seeking investment. Venture capital trends in 2025 reflect a market in transition, with record-breaking Q1 funding followed by unexpected turbulence. With $91.5 billion invested in Q1 alone—the second-highest quarterly investment in a decade—the initial outlook appeared promising. However, geopolitical uncertainties and economic volatility have created a more complex funding environment than many anticipated.

The State of Venture Capital in 2025

Despite early optimism, 2025 has delivered a mixed bag for the venture capital ecosystem. The year began with impressive momentum, as Q1 saw an 18.5% increase in funding compared to the previous quarter. However, this surge has been tempered by market realities that have emerged as the year progressed.

Geopolitical uncertainty has emerged as the primary concern among investors, receiving 7.5% of votes in recent venture trend surveys. This uncertainty, coupled with President Trump’s tariff policies, has triggered stock market volatility and recession fears, significantly impacting the exit landscape that many VCs had been counting on.

The anticipated wave of IPOs and acquisitions that would recycle capital back into the startup ecosystem has largely failed to materialize. Several high-profile companies, including fintech giant Klarna and physical therapy innovator Hinge, have postponed their public debuts amid the market turbulence. This delay in liquidity events has created a bottleneck in the traditional venture capital cycle.

Nevertheless, there are signs of improvement compared to previous years. Interest rates have begun to stabilize, M&A activity is gradually increasing, and limited partners appear to be allocating more capital to venture funds. This suggests that while 2025 may not deliver the banner year many hoped for, the foundations for recovery are being established.

AI Investment: Evolution Not Revolution

Photo by Enock Gabriel on Pexels

Artificial intelligence remains the dominant force in venture capital trends in 2025, but the nature of AI investments has matured significantly. According to recent data, AI attracted $19 billion in Q3 2024 alone, representing 28% of all venture dollars. This trend has continued into 2025, with both funding strategies and product roadmaps heavily influenced by generative AI (GenAI) and machine learning (ML) technologies.

However, the AI landscape is experiencing a notable shift toward consolidation. As certain AI technologies become commoditized, the market is increasingly dominated by fewer, stronger players. In the Large Language Model (LLM) space, for instance, OpenAI, Google, and Anthropic have established clear leadership positions, making it difficult for newcomers to gain traction without significant differentiation.

This consolidation has also driven an acquisition trend, with many companies opting to purchase AI startups rather than developing proprietary AI technology. This has placed a premium on startups with unique data assets, as these proprietary datasets provide a competitive moat that generic AI implementations cannot match.

For founders operating in the AI space, the message from investors is clear: generic AI solutions are no longer sufficient to attract funding. Venture capitalists are increasingly focused on defensible business models that can generate sustainable revenue. The days of securing investment based merely on the inclusion of AI buzzwords in a pitch deck are firmly behind us.

The Impact of Market Volatility on Funding Strategies

Photo by RDNE Stock project on Pexels

The economic turbulence of 2025 has forced both investors and founders to adapt their funding strategies. The volatility triggered by geopolitical tensions and policy shifts has created a more cautious investment environment, with VCs placing greater emphasis on fundamentals and sustainable growth.

This shift is particularly evident in the later stages of funding, where investors are conducting more thorough due diligence and setting higher bars for follow-on investments. Valuations, which had reached stratospheric levels during the previous AI hype cycle, are now being recalibrated to reflect actual business performance and market conditions.

For early-stage startups, this environment presents both challenges and opportunities. While securing initial funding may require more compelling evidence of product-market fit, the reduced competition for attention can benefit truly innovative companies. Founders who can demonstrate clear paths to profitability and realistic growth trajectories are finding receptive audiences among investors seeking quality over quantity.

The volatility has also influenced the timing of funding rounds. Many founders are opting to extend their runways through operational efficiency rather than raising additional capital in a challenging environment. This strategic patience allows companies to wait for more favorable market conditions before seeking their next round of funding.

Additionally, alternative funding mechanisms have gained prominence. Revenue-based financing, venture debt, and strategic corporate investments have become increasingly important components of the funding mix as founders seek to diversify their capital sources in response to traditional venture capital constraints.

Sector-Specific Investment Trends

Photo by Google DeepMind on Pexels

While AI continues to dominate the venture capital landscape in 2025, several other sectors have emerged as significant areas of investment focus. Deep Tech and Robotics have shown particularly strong growth, capturing 6.7% of investor interest according to recent surveys.

The Deep Tech sector, encompassing quantum computing, advanced materials, and biotechnology, has benefited from increasing recognition of its long-term transformative potential. Investors are demonstrating greater willingness to accept the extended timelines typically associated with Deep Tech development, particularly when these technologies address fundamental challenges in healthcare, climate, or computing.

Robotics has seen accelerated adoption across multiple industries, driven by labor shortages and the need for operational resilience. Automation solutions that enhance productivity in manufacturing, logistics, and healthcare have attracted significant investment, with particular emphasis on systems that can be deployed and scaled rapidly.

Climate tech continues to attract substantial capital, with focus shifting from general sustainability plays to specific technologies addressing measurable carbon reduction, energy efficiency, and climate adaptation. The regulatory environment, including carbon pricing mechanisms and clean energy incentives, has created tailwinds for startups operating in this space.

Fintech investment has become more selective, with emphasis on solutions that address specific pain points in financial infrastructure, compliance, or inclusion. The sector has moved beyond the initial wave of consumer-facing applications to more complex challenges in the financial ecosystem.

Healthcare technology, particularly solutions leveraging AI for diagnostics, personalized medicine, and operational efficiency, remains a priority for many investors. The pandemic-accelerated digital transformation of healthcare continues to create opportunities for startups addressing both clinical and administrative challenges.

Geographic Shifts in Venture Capital

Photo by Mikhail Nilov on Pexels

The venture capital landscape of 2025 reflects significant geographic diversification beyond the traditional hubs. While Silicon Valley remains an important center of activity, capital has continued to flow to emerging ecosystems both within the United States and globally.

Within the US, cities like Austin, Miami, and Denver have solidified their positions as viable alternatives to the coastal tech hubs. These locations offer compelling combinations of talent, quality of life, and increasingly sophisticated investor networks. The normalization of remote work has accelerated this trend, allowing startups to access capital without necessarily relocating to traditional venture centers.

Internationally, several regions have emerged as important players in the global venture ecosystem. Southeast Asia continues its strong growth trajectory, with Singapore serving as a regional hub and Indonesia’s massive market driving significant investment. India’s startup ecosystem has matured considerably, with more companies reaching scale and generating meaningful returns for early investors.

Europe has seen particular strength in specific sectors, including fintech, enterprise software, and sustainability. The continent’s regulatory environment, once viewed primarily as a constraint, is increasingly recognized as creating opportunities for startups addressing compliance, privacy, and environmental challenges.

Latin America has also attracted increased attention, with Brazil and Mexico leading the way in fintech adoption and digital transformation. The region’s large, underserved markets present significant opportunities for business model innovation and technology leapfrogging.

This geographic diversification has been accompanied by the emergence of specialized investors focused on specific regions or ecosystems. These investors often bring valuable local knowledge and networks that complement the financial resources of global venture firms.

Strategies for Founders in the Current Funding Climate

Photo by RDNE Stock project on Pexels

For founders navigating the venture capital landscape of 2025, adapting to the current funding climate is essential. The days of easy money and growth-at-all-costs strategies have given way to a more disciplined approach focused on sustainable business fundamentals.

First and foremost, founders must recognize that the bar for funding has been raised across all stages. Investors are placing greater emphasis on clear paths to profitability, defensible competitive advantages, and efficient capital utilization. Pitch decks that once focused primarily on total addressable market and growth potential now require more detailed financial projections and unit economics.

Building relationships with potential investors well before fundraising has become increasingly important. The most successful founders are engaging with VCs months or even years before they need capital, providing regular updates and demonstrating consistent progress. This approach allows investors to track a company’s development over time, building confidence in the team’s execution capabilities.

Diversifying funding sources has emerged as a key strategy for resilience. Smart founders are exploring a mix of traditional venture capital, strategic corporate investment, venture debt, and revenue-based financing. This diversification not only reduces dependence on any single capital source but can also provide strategic benefits beyond the funding itself.

Operational efficiency has taken center stage in investor discussions. Founders who can demonstrate thoughtful resource allocation and capital efficiency are finding more receptive audiences. This doesn’t mean abandoning growth ambitions, but rather pursuing growth in a more measured and sustainable manner.

Finally, timing has become a critical consideration in fundraising strategies. Founders who have the flexibility to time their raises during windows of market optimism can secure better terms and valuations. This requires maintaining sufficient runway to weather periods of market volatility without being forced to raise capital in unfavorable conditions.

The Outlook for Venture Capital Through 2025 and Beyond

Photo by Kindel Media on Pexels

As we look toward the remainder of 2025 and into the future, several factors will shape the evolution of the venture capital landscape. While current market conditions present challenges, historical patterns suggest that periods of correction often set the stage for the next wave of innovation and value creation.

The exit environment, which has underperformed expectations in early 2025, shows signs of potential improvement. As market volatility subsides and investors adjust to new economic realities, the IPO window may reopen for well-prepared companies with strong fundamentals. Similarly, strategic acquisitions are likely to accelerate as corporations deploy their substantial cash reserves to acquire innovation and talent.

Fund formation activity provides another reason for cautious optimism. Despite the challenging environment, new venture funds continue to be raised, albeit with more selective limited partner participation. These newly formed funds will need to deploy capital, creating opportunities for startups that align with their investment theses.

The venture capital trends of 2025 also point to a continued evolution in investment criteria. While growth remains important, investors are placing increasing value on capital efficiency, defensible business models, and clear paths to profitability. This shift favors founders who can build sustainable businesses rather than those focused solely on growth metrics.

Technology adoption cycles continue to accelerate, creating opportunities for startups that can help enterprises navigate digital transformation. The integration of AI, automation, and data analytics into core business processes represents a massive market opportunity that will drive investment for years to come.

Finally, demographic and societal shifts are creating new markets and business models. Aging populations in developed economies, the rise of Gen Z as consumers and workers, and changing attitudes toward sustainability and purpose-driven business all represent significant opportunities for innovative startups.

Conclusion: Navigating the New Venture Landscape

Photo by MART PRODUCTION on Pexels

The venture capital trends of 2025 reflect a market in transition—moving from the exuberance of previous years to a more measured approach focused on sustainable value creation. While this adjustment presents challenges for founders accustomed to abundant capital and sky-high valuations, it also creates opportunities for those building businesses with solid fundamentals and defensible advantages.

For founders, success in this environment requires adaptability, discipline, and strategic patience. Building relationships with investors, demonstrating capital efficiency, and timing fundraising efforts thoughtfully have become essential skills. The most successful startups will be those that can balance growth ambitions with financial sustainability.

Investors, too, are adapting their approaches—conducting more thorough due diligence, setting higher bars for follow-on investments, and placing greater emphasis on paths to profitability. This increased selectivity ultimately strengthens the ecosystem by directing capital to the most promising opportunities.

Despite the challenges, innovation continues to accelerate across multiple domains. AI, Deep Tech, climate solutions, and healthcare transformation represent massive opportunities for startups addressing fundamental societal and economic needs. The companies that successfully navigate the current funding environment while delivering meaningful innovation will be well-positioned for success as market conditions evolve.

The venture capital landscape of 2025 may not match the exuberance that many hoped for at the year’s outset, but it provides fertile ground for the next generation of transformative companies. By understanding and adapting to these venture capital trends, founders can position themselves to not just survive but thrive in this new investment reality.

Sources

- https://govclab.com/2025/04/08/q2-2025-venture-trends-results/

- https://techcrunch.com/2025/04/16/startup-funding-hit-records-in-q1-but-the-outlook-for-2025-is-still-awful/

- https://www.gartner.com/en/articles/2025-trends-for-startup-ceos

- https://stripe.com/resources/more/startup-industry-trends-for-2025-what-founders-need-to-know

- https://waveup.com/blog/venture-capital-trends-2025/